Here is a summary of the presentation from an investors conference held on 6 May including a link to the full presentation from ASX

Click here to download the PDF of the full presentation from ASX.

to download the PDF of the full presentation from ASX.

Summary

- Corporate rating BB (stable) / Ba2 (stable). Bond rated B+ / Ba3

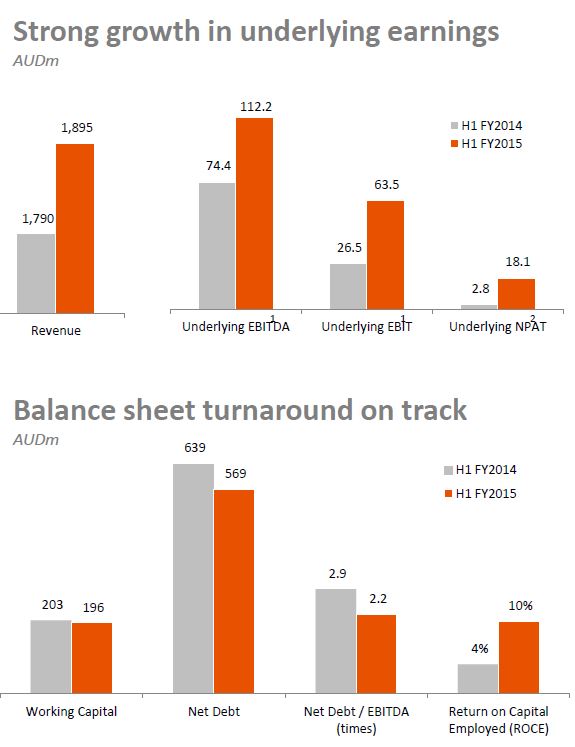

- Has reaffirmed FY15 EBITDA guidance in the range of A$260-A$280m

- Business turnaround is well progressed – compound average growth rate of EBITDA of 15% between FY13-FY15

- Balance sheet repair on track- net debt to EBITDA on track to reach <2.0x target by FY15 end

- $8.8bn of work in hand

- Manus Island contract renewal in October 2015 - renewal is expected, but at lower volumes and margins going forward

- Good likelihood of early call on bond in 2017 if bond prices remain around current levels (i.e.: well above par)

Source: Transfield Services